HEC Paris MIF

Rankings | Class Profile | Employment Report | Sample Essay | Interview Questions

HEC Paris MIF Introduction

HEC MIF Class Profile brings together diverse students with different goals in its portfolio. HEC Paris MIF program aims to fulfill two objectives within a short period of time: lay the necessary foundations for any career in finance and provide in-depth knowledge in each student’s field of specialization. Scroll down for further information on HEC MIF Average GMAT, HEC Mif Class Profile, HEC MIF Application Process, employment report, HEC Paris MIF fees, and more.

We achieve this goal by leveraging on the specific knowledge and experience students have acquired before joining HEC Paris:

- Business track students: have already taken at least introductory level courses in financial accounting, corporate finance, financial markets, derivatives, and statistics in a Tier-1 international business school or university. They frequently have had first internships in banking or consulting and are looking for an advanced set of tools to jump-start their career.

- Accelerated track students: have received a first-class education in a highly quantitative field (maths, physics, engineering, econometrics…) and wish to switch their field to finance. They may or may not have taken some courses in finance and they may or may not have had the first internship in banking or consulting.

WHO IS IT FOR?

The HEC Paris Master in Finance programme is for people who are coolheaded, precise thinkers with a talent for numbers, a passion for finding the right answers and a desire to launch a career in finance.

WHAT WILL YOU LEARN?

HEC Paris Master in Finance program will help you to learn fundamental tools and concepts and develop a broad, international perspective on competitive capital markets. You’ll learn how successful companies connect finance and strategy, and hone your ability to make decisions.

WHERE WILL IT TAKE YOU?

Common new graduate roles for the HEC MIF class profile include:

Financial services (investment banks, hedge funds, regulatory agencies), Consulting, Fintech, Or financial and management positions including Services.

| Program Starts | September 2020 |

| Duration | 10 Months |

| Location | Paris, France |

| Intake 2020 | 1 |

| QS World Global MIF 2020 Ranking | #3 |

| HEC Paris MIF Fees | € 33,625 |

| HEC Paris MIF Application Deadlines | 22 October to 10 June (For intermediate deadlines see application deadline section) |

| HEC Paris MIF Application Process | . GMAT/GRE score · 2 completed online reference forms · English language proficiency test report (IELTS/TOEFL) . CV (For more details see application process section) |

- Business track students: have already taken at least introductory level courses in financial accounting, corporate finance, financial markets, derivatives and statistics in a Tier-1 international business school or university. They frequently have had first internships in banking or consulting and are looking for an advanced set of tools to jump-start their career.

- Accelerated track students: have received first class education in a highly quantitative field (maths, physics, engineering, econometrics...) and wish to switch their field to finance. They may or may not have taken some courses in finance and they may or may not have had a first internship in banking or consulting.

Business and accelerated tracks mainly differ in courses taught during the Fall term.

Business track students follow the same courses as the “Majeure Finance” students of the HEC Master in Management program, starting all courses at an advanced level and getting a first opportunity to specialize through “block electives”.

Accelerated track students start all finance courses at an introductory level. However, they go through an intensive Fall term where courses are taught making full use of their strong quantitative skills.

- Soft skills seminar

- Ethics seminar

- Probability and statistics refresher

- Behavioral Finance

- Corporate valuation (2)

- Securities markets (2)

- Financial statement analysis (2)

- Introduction to finance (1)

- Corporate finance (1)

- Financial accounting and reporting (1)

- International macroeconomics (1)

- Empirical Methods in Finance

- Asset management (2)

- Financial regulation

(1) Accelerated Track only

(2) Business Track only

- Fixed income and MM

- Empirical Methods in Finance 2

- Securities Markets (1)

- International Finance (2)

- Capital markets specialization courses:

- Financial engineering

- Quantitative asset management

- Corporate finance specialization courses:

- Corporate restructuring

- Derivatives

(1) Accelerated Track only

(2) Business Track only

Corporate investment & financing policy:

- Advanced financial accounting

- Financing decisions of firms

- Financial solutions for corporates

- Equity capital markets

- Entrepreneurial finance

Corporate restructuring:

- Mergers & acquisitions

- LBO structuring and modeling in practice

- Real options

- Private equity

- Value / distressed investing

Corporate strategy:

- Corporate Strategy & Financial institutions

- Topics in Valuation

- Behavioral strategy

- Financial dimensions of strategic decisions

- Strategy for International Expansion

Financial engineering:

- Energy Markets

- Stochastic processes

- Modeling techniques for financial engineering

- FX derivatives trading

- Origination of structured products

Capital markets:

- Financial engineering & derivative products

- Bond portfolio management

- Sustainable & responsible investment

- Alternative investments

- Ethics: Financial analysts and portfolio managers

Date and Science:

- Introduction to Applications of Data Science to Management

- Data Analysis in Finance

- Digital Regulation and Compliance in the Financial Sector

- Economic Value of Data

- Blockchain

At the beginning of September, students have the opportunity to go on a study trip to London. The trip offers students plenty of networking opportunities, conferences and team building exercises. Many networking events are organized with HEC Alumni’s UK branch - one of the largest in the world, with numerous active members working in the City.

The 2017-2018 London study trip included company events with:

- Bank of America - Merrill Lynch

- Barclays

- BNP Paribas

- Blackstone

- Boussard & Gavaudan

- Commerzbank

- Crédit Agricole

- Exane

- Goldman Sachs

- HSBC

- Morgan Stanley

- Société Générale CIB

- Thomson Reuters

- Unicredit...

Discover the 2017 study trip from the inside.

MIF Career Fairs

Bank Presentation on Campus

Filmed Mock Interviews

Database of 1800+ interview questions

The International Finance Forum ( October)

MSc International Finance students must write a professional thesis and fulfill a professional experience requirement in order to graduate. The professional thesis may either be written while on campus or during the internship under the joint supervision of a professional and an HEC faculty member. It constitutes an important component of the HEC MIF learning experience. The objective of the thesis is to explore how cutting-edge research is being implemented in the daily practice of finance in a highly competitive environment.

This 2-year double degree program was created in Fall 2012 in collaboration with the School of Economics and Management of the premier Chinese university, Tsinghua University. HEC students who want to join the double degree program need to apply during the Spring term of the HEC MIF.

Pre-selection will be made on the basis of academic results in the Fall term and final decisions will be made after an interview with Tsinghua SEM Faculty members. Selected students will join the Tsinghua SEM Master in Finance for a second year of study and receive the two degrees of HEC MIF and Tsinghua SEM Master in Finance.

The double degree program with Tsinghua SEM is the opportunity to combine strong academic training in Finance offered by leading programs with a unique cross-cultural experience. It requires fluency in Chinese.

Sponsored by a company, Certificates are a set of interdisciplinary courses corresponding to approximately 100 contact hours as well as business projects and other types of field work related to a given sector. Each student selected (in the 1st semester) for a certificate will be awarded an additional HEC certificate if he/she validates all the requirements of the course.

- Digital entrepreneurship

- Digital transformation

- Energy & Finance

- Excellence in client experience

- Luxury

- Mergers & Acquisitions

- Social business/ Enterprise & Poverty

| Class Size | 100 |

| Nationalities | 36 |

| Female | 48% |

| Average Age | 23 |

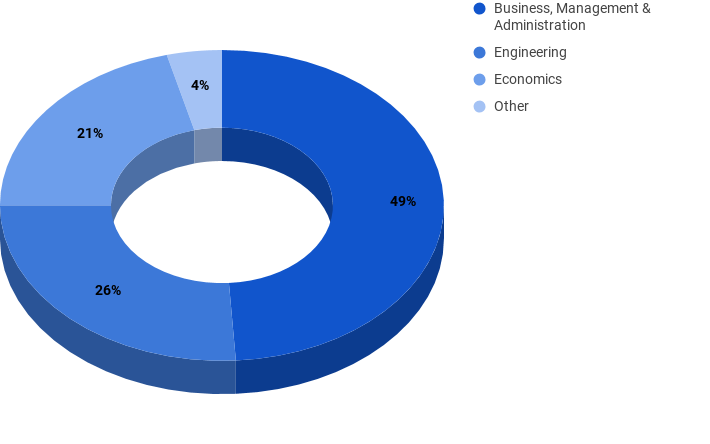

HEC Paris MIF Students Academic Backgrounds

| Undergraduate Sector | Percentage |

|---|---|

| Business, Management & Administration | 49% |

| Engineering | 26% |

| Economics | 21% |

| Other | 4% |

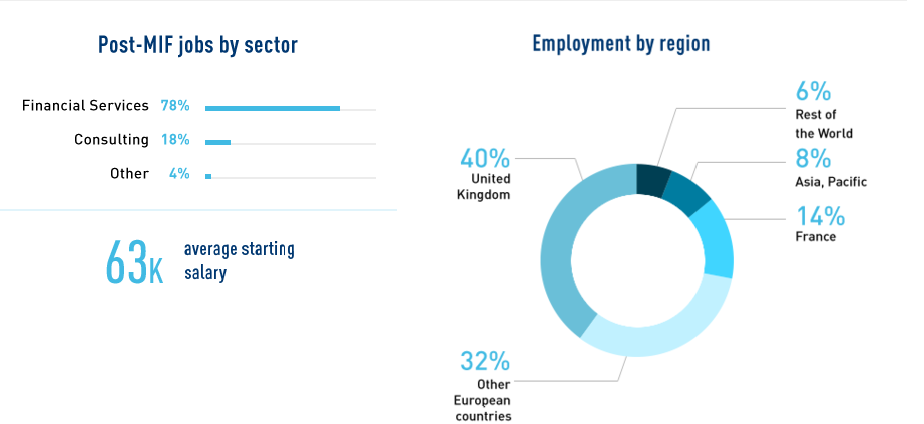

HEC Paris MIF Placements

HEC Paris Master in Finance Placements Facts

- 99% Employed within 3 months

- 67% Work outside their home country

- €63,000 Average starting salary

- €136,000 Average salary after 3 years

- 5 Job fairs on Campus

- Over 300 companies recruited HEC graduates

HEC Paris Alumni Info

The HEC Paris alumni network is a storehouse of successful stories of top executives and entrepreneurs. From analyst and consultant positions in Mckinsey, Amazon, Philips to founders of powerful business enterprises, they have achieved it all. More than 52,000 of the alumni are working across different sectors all around the world. The network is among the largest in Europe with the alumni based in over 132 countries. The network organizes more than 1000 events to facilitate exchange between students and members and, also to provide counseling to prospective students.

| Rounds | Application Deadlines | Admissibility Results | Admission Results |

|---|---|---|---|

| Round 1 | 22 Oct 2019 | 14 Nov 2019 | 29 Nov 2019 |

| Round 2 | 7 Jan 2020 | 30 Jan 2020 | 26 Feb 2020 |

| Round 3 | 3 Mar 2020 | 26 Mar 2020 | 22 Apr 2020 |

| Round 4 | 28 Apr 2020 | 20 May 2020 | 10 June 2020 |

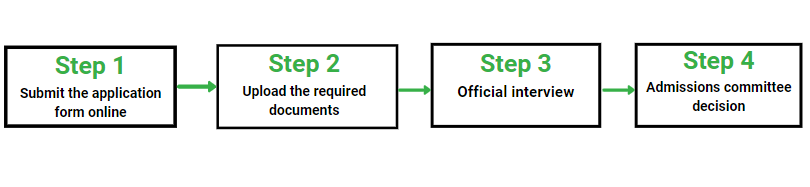

HEC MIF Application Process

Eligibility for HEC MIF Application Process

- Bachelor or Master’s degree from an international institution – 2:1 honors or above is a prerequisite in HEC MIF Application Process.

- Have prior training (at least introductory level) in financial accounting, corporate finance, investments, derivatives, business statistics, and calculus.

Documents required for HEC MIF Application Process

- Degree certificate(s) or current enrollment certificate

- All official academic transcripts obtained in a higher education institution (exchange programs included) with official GPA

- Résumé (CV)

- GMAT or GRE or TAGE MAGE official test score report

- English language proficiency test score report: TOEFL or TOEIC (Bridge or Listening and Reading or Speaking and Writing) or IELTS or Cambridge

- 2 completed online reference forms (at least one should be filled out by a professor)

- Passport-style photo

- Non-refundable application fee of €110

Students admitted to HEC Paris Master in Finance program will be asked to confirm their seats within 3 weeks after final results are announced with a non-refundable deposit of €5,000, deducted from their total tuition fees. Remaining costs (approximately €1,000 per month) include housing and food, compulsory insurance (health and civil liability), sports and leisure, phone and IT access.

| Academic Year | Academic Fees | Student Service Fees | Administrative Fees | Total tuition Fees |

|---|---|---|---|---|

| 2020/2021 | € 30,625 | € 1,600 | € 800 | € 33,625 |

HEC Paris Master in Finance Funding

HEC Scholarships

HEC Foundation Excellence Scholarships

HEC Foundation Excellence Scholarships have been made possible thanks to the considerable support from the community of alumni and businesses related to the HEC Paris Foundation.

- Eligibility: All candidates with a non-French diploma (Bachelor’s or Master’s Degree: admitted to one of our master programs

- Process: All admitted candidates with a non-French diploma (Bachelor’s or Master’s Degree) are automatically considered for HEC Foundation Excellence scholarship. No additional document is required

- Deadline: Results from this scholarship are announced by email within 2 weeks after admission and before the confirmation deadline.

HEC Foundation Excellence Scholarships’ final decision is based on academic excellence, the overall strength of the application, the results of the selection interview and the candidate’s GMAT/GRE/TAGE-MAGE performance. Scholarships are deducted from tuition fees.

The Eiffel Excellence Scholarships

The Eiffel Excellence Scholarship was established by the French Ministry for Europe and Foreign Affairs to enable French higher education establishments to attract top international students to their master’s and PhD programs. On the masters level, the scholarship encourages applications from emerging countries to shape the future decision-makers of the private and public sectors in priority areas of study.

- Application deadline : Opening of the call for applications: week of October 21th 2019 .Deadline for the reception of applications by Campus France: January 9th 2020. Publication of results: week of March 23th 2020.

- Eligibility: Candidates aged 30 years old or below. Non-French nationality candidates only (applicants with dual nationality, one of which is French, are not eligible). Candidates who have already been awarded the Eiffel scholarship at master’s level (not eligible at the same level, but can nevertheless reapply at a doctoral level). Candidates who have applied previously and been rejected, even if their application is submitted by a different establishment or in another field of study.

- Grant: Monthly allowance of €1181. The scholarship also covers: one international return ticket, social security and cultural activities.

- Publication of results: The list of laureates will be published on the Campus France website during the week of March 23, 2020.

N.B.: The Eiffel scholarship can not be cumulated with any other French government scholarship or award.

LOANS

Bank Loans

Most banks will provide loans for study at HEC Paris to French nationals or residents with pre-established banking credentials at very low interest rate (around 1% in 2016). HEC have excellent relationships with local branches of national banks Furthermore, information sessions with bank representatives are organized on campus every year during the first 3 weeks of September.

Finally, the European Commission Erasmus+ Program allows students following a master abroad to benefit from soft loans until 18.000€ (2-year programs). To be eligible students must live in a programme country and their study destination cannot be in their country of residence or the country where they received their first qualification. More information on the European Commission website.

Prodigy Finance Loan Scheme

Prodigy Finance offers community-funded tuition covering loans to students from over 150 nationalities (under certain conditions). The loan is transferred directly to HEC Paris at the start of the program. This loan will not cover living expenses and the deposit to secure the seat in the program.

- Eligibility to apply: Be admitted to one of this Master’s programs: Master in Management – Grande Ecole, MSc Accounting and Financial Management, MSc Strategic Management, MSc International Finance, MSc Managerial and Financial Economics, MSc Marketing, MSc Sustainability and Social Innovation. Be of non-French nationality. French citizens and permanent residents may search for student loans with French banks.

- Preliminary lending conditions: A full credit and background check. Your acceptance into the program at HEC Paris specified in your loan application

HEC Paris Master in Finance Sample Essays

What do you consider your most significant life achievement? (250 words)

Leading and managing one of the biggest annual media engagement tours hosted by my client-salesforce.com has been one of my significant achievements to date. A three-day tour, it’s the only platform for the media across geographies to engage with the experts of the cloud computing arena. In my two years of servicing this account only senior resources such as Account, Directors have managed such tours. My interaction with the client and the trust of the senior management helped me contract this opportunity at an early stage of my career. A couple of factors that made this opportunity distinctly were- being nominated by the client, learning experience, and varied exposure.

The expectations from the PR agencies ranged from the appropriate nomination of senior-level journalists, managing journalist travel, managing media expectations, ensuring media coverage justifying the travel, working out the story ideas with the media, to conducting an exclusive session for the Indian media with Mr. ABC, Chairman, Asia’s biggest telecom company The key pull-off for the 5 journalists traveling from India was the 30 minutes facetime with the Chairman on Day 3 of the tour. A crisis situation arose when the interaction with Mr. ABC was called-off half an hour before the scheduled time due to a shortage of his time.

Since the media people from India were experienced and well researched, they had extremely strategic questions to Mr. ABC but his unavailability gave the media the opportunity to write a negative article on Salesforce.com. It was a grave situation as I had to ensure that no negative coverage appeared and also convince the corporate communications team to respond to each query overnight. We could not take a chance by not commenting on any issue no matter how controversial it was. I worked closely with the corporate communications team and the media to ensure all gaps were covered. The result despite the adversity was positive front-page articles on salesforce.com in Hindustan Times, The Hindu Business Line, and an interview of Mr. ABCin Business ASIA. Personally, it was a great professional accomplishment, incredible on-job learning, and truly enriching experience.

HEC Paris Master in Finance Interview Questions

HEC asks candidates who are invited to interview to make a short 10-minute presentation on a subject of their choice. This is an opportunity to showcase your composure and clarity of thought, ability to deliver a coherent argument or explanation and to express both creativity and passion in your presentation. It does not have to relate to your job or career – in fact, some of the best presentations don’t – but it should be a subject that is relevant to you, and that you can communicate well to the interviewer. It’s also important that you keep your presentation short – five or six slides should be plenty, including the introductory slide. What you want to do in 10 short minutes is impress a concept or new way of thinking to your interviewer and show how you have come to a specific conclusion or observation. Keep it engaging and interesting, too – the more memorable, the better.